Article 136 TFEU amendment, the ESM and the Fiscal Compact Treaty

national |

eu |

feature

national |

eu |

feature  Tuesday April 24, 2012 06:00

Tuesday April 24, 2012 06:00 by Sonya Oldham - People's Association Watchdog

by Sonya Oldham - People's Association Watchdog pawireland at hotmail dot com

pawireland at hotmail dot com

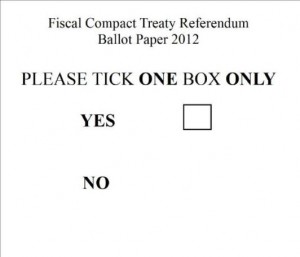

Presently we are being given a referendum on the 'Treaty on Stability, Coordination and Governance in the Economic and Monetary Union', ( the Fiscal Compact Treaty), this treaty lays out the 'conditions' of receiving a bailout from the European Stabilty Mechanism, which so far we are not being given a referendum on. These 3 aspects are inextricably intertwined, with the ESM being the mechanism, the article 136 TEFU amendment the instrument being used to enable the ESM to have a legal basis, while the fiscal compact treaty sets out the conditions for accessing finance through the ESM.

There are in fact 3 different aspects, only the last of which we are allowed a say on:

1. The article 136 TFEU amendment to the treaties.

2. The ESM treaty

3. The Fiscal Compact Treaty.

External Links:

Fiscal Treaty will copper fasten austerity, make even emergency public expenditure impossible, and worsen poverty |

Fiscal Treaty Files: The Fiscal Treaty is Unsafe, Uncertain and Unnecessary | Democracy instead of the Fiscal Treaty! |

Do you know what the fiscal compact treaty is all about? |

Fiscal Treaty Referendum Poll Result |

Fiscal Treaty Files: The Fiscal Treaty is Unsafe, Uncertain and Unnecessary | Generating an Improved Debate on the Fiscal Treaty | Austerity Treaty flies in the face of 1916 Proclamation – Ó Caoláin |

Why this really is an Austerity Treaty | EU summit adopts Fiscal Pact for European-wide austerity

Indymedia Links:

People's Movment: Ireland has better options | Thomas Pringle Q&A: ESM Constitutional Challenge | Important Background & Analysis on SCG ("Fiscal Compact") Treaty, for Dáil Debate on Irish Referendum (Wed., Thurs., Fri.) | Irish Constitutional challenge to ESM |

The Recession, Bank Bailout or our Deficit? | Mandate To Default On The Unjust Bank Debt That Is Sinking Our Economy

Events: EU Permanent Austerity Treaty - why you should vote NO!

Document: ![]() The Fiscal Treaty

The Fiscal Treaty

No Campaign Websites:

http://www.nofiscaltreaty.net/ - Fight back and vote No! |

http://no-fiscal-treaty.org/ |

http://voteno.ie/ - Vote No to the EU Austerity Treaty |

http://www.FarmersForNo.eu - Farmers For No

The Background

The original budgetary discipline code for the Eurozone, the so-called Stability and Growth Pact, collapsed in all but name in the years leading up to 2005 over the unwillingness of the administrations in Germany and France, respectively, to allow sanctions to be applied to their respective countries. More recently with the multi-billion euro bailout of Greece, the issue of economic governance in the Eurozone returned to the agenda.

By 29 September 2010, the Commission had already proposed legislative measures in the field of economic governance, followed on 21 October by the Final Report of the Von Rompuy Task Force, concerning fiscal discipline, surveillance mechanisms, deeper coordination, crisis management and stronger institutions.

Treaty reform featured nowhere on the agenda in all this, however, until the meeting between German chancellor Angela Merkel and French President Nicolas Sarkozy on 18 October 2010 produced a declaration specifically calling for, inter alia, treaty changes in order to set up a crisis mechanism (in effect, a bailout fund) for the euro.

It should be explained that up until now, the possibility of the grant of financial assistance where needed to safeguard the stability of the euro as a whole, has been governed by Article 125(1) of the Treaty on the Functioning of the European Union with its provision that;

"the Union shall not be liable for or assume the commitments of central governments, regional, local or other public authorities, other bodies governed by public law, or public undertakings of any Member State, without prejudice to mutual financial guarantees for the joint execution of a specific project. A Member State shall not be liable for or assume the commitments of central governments, regional, local or other public authorities, other bodies governed by public law, or public undertakings of another Member State, without prejudice to mutual financial guarantees for the joint execution of a specific project."

This long-standing so-called 'no bailout' clause has until now been balanced in the Treaty for the most part only by the provision in Article 122(2) TFEU that:

"...where a Member State is in difficulties or is seriously threatened with severe difficulties caused by natural disasters or exceptional occurrences beyond its control, the Council, on a proposal from the Commission, may grant, under certain conditions, Union financial assistance to the Member State concerned. The President of the Council shall inform the European Parliament of the decision taken."

The ESFS bailouts were challenged in May 2010 by a number of German economists who had commenced litigation before the Court in which they argued that the assistance to Greece and the euro rescue fund violated the ‘no bailout’ clause found in Article 125 of the Treaty, and, further that Article 122 which had been used to justify both initiatives - provided no legal justification for them. The considerable risk that the Karlsruhe Court could well rule both measures illegal constituted a considerable incentive for pre-emptive political action.

Beginning with the Brussels European Council of 28 - 29 October 2010 the need for Member States to establish a “permanent crisis mechanism”, was agreed on, the stated aim of which was “to safeguard the financial stability of the euro area as a whole”.

By 28 November, Euro-area finance ministers had reached agreement on a future European Stability Mechanism to replace the existing European Financial Stability Facility (EFSF). The idea of this new Mechanism was that it would safeguard financial stability and complement a new framework for reinforced economic surveillance in the European Union (Fiscal compact). More specifically, the conclusions of the so-called 'Eurogroup' noted that:

“The [European Stability Mechanism] will complement the new framework of reinforced economic governance, aiming at an effective and rigorous economic surveillance, which will focus on prevention and will substantially reduce the probability of a crisis arising in the future.''

''Assistance provided to a euro area Member State will be based on a stringent programme of economic and fiscal adjustment and on a rigorous debt sustainability analysis conducted by the European Commission and the [International Monetary Fund], in liaison with the ECB.”

The next major step in the process of Treaty amendment was the European Council meeting of 16 - 17 December 2010, which saw the agreement of the heads of state and government on the precise content of the proposed amendment.

"This mechanism will replace the European Financial Stability Facility (EFSF) and the European Financial Stabilisation Mechanism (EFSM), which will remain in force until June 2013. As this mechanism is designed to safeguard the financial stability of the euro area as a whole, the European Council agreed that Article 122(2) TFEU will no longer be needed for such purposes. Heads of State or Government therefore agreed that it should not be used for such purposes."

The key provision of this Draft European Council Decision amending Article 136 of the Treaty is Article 1. This provides that the following paragraph shall be added to Article 136 of the Treaty on the Functioning of the European Union.

"The Member States whose currency is the euro may establish a stability mechanism to be activated if indispensable to safeguard the stability of the euro area as a whole. The granting of any required financial assistance under the mechanism will be made subject to strict conditionality."

In order to effect this proposed amendment, the European Council decided to launch "immediately" the simplified revision procedure provided for in Article 48(6) of the Treaty on European Union, the completion of which should see national approval procedures by the end of 2012, and entry into force on 1 January 2013. (1)1

So what is this article 136 TFEU amendment to the treaties?

Article 122.2 was the specific authority for the temporary fund (EFSF), but it limits “Union financial assist finance” to situations where “a Member State is in difficulty or is seriously threatened with severe difficulties caused by natural disasters or exceptional occurrences beyond its control.” It is for this reason that the European Council agreed that Article 122.2 of the TFEU would not be the “appropriate Treaty Article for the permanent European Stability Mechanism (ESM)” and “will no longer be needed for such purposes.”

To avoid having to organise referendums in Europe once more, they used article 48.6 of the Treaty of the European Union, which allows the European Council to decide changes in the articles of the treaty, under condition they don’t constitute an extension of the competences of the EU.

Using the simplified revision procedure, the European Council adopted Decision 2011/199/EU to amend Article 136 TFEU to allow Eurozone states to create a permanent financial support mechanism. The Decision states that it shall enter into force on 1 January 2013. (3)

This amendment will give a long-term legal basis in European law to the ESM, the permanent bail out fund. The Government wants the Dáil and Seanad to approve this hugely important Article 136 TFEU amendment to the EU treaties without any referendum even though this amendment and its legal/political consequences would mark a qualitative change in the direction of the EU. The amendment to Article 136 would extend the scope of the existing EU treaties significantly and bears a huge weight of legal/political consequences. It reads: “The Member States whose currency is the euro may establish a stability mechanism to be activated if indispensable to safeguard the stability of the euro area as a whole. The granting of any required financial assistance under the mechanism will be made subject to strict conditionality.” (2)

The government would argue that the European Stability Mechanism amendment is about iron-cladding existing competences rather than about creating new competences.

However, Amendment 136 replaces an already extant but contested legal basis for rescue action with an uncontested one clearly allowing for a permanent rescue mechanism.

This will be the first amendment to the actual text of either of the two constitutive Treaties of the European Union since the Treaty of Lisbon. (1)

Questions Arising?

If it is about iron cladding, why was the actual text changed?

Does it create new competences?

Does the Article 136 TFEU amendment to the EU Treaties claim to give an assertion of, significant extension of EU powers, scope and competences which cannot legally be brought into force in Ireland by the “simplifed” EU treaty revision procedure of Art.48(6) TEU that was used to adopt the amendment???

The European Stability Mechanism (ESM)

The treaty establishing the European Stability Mechanism (ESM), a permanent bail-out fund for the euro zone, was signed in Brussels on February 2nd. It now needs to be ratified by the 17 members of the single currency, with the aim of coming into force in July. The ESM is designed to be a permanent successor to the European Financial Stability Facility (EFSF), and goes hand in hand with a fiscal compact designed to ensure budgetary discipline among euro-zone members. (4)

The ESM will be an intergovernmental institution established under public international law by a treaty signed by the euro area countries. (5)

The European Stability Mechanism Treaty sets up the European Stability Mechanism as an entity with legal personality, of which Ireland would become a member. It sets out the institutional structure and rights and privileges of this “Mechanism”.

The Mechanism will include a permanent €500 billion bailout fund and the treaty stipulates the contributions which each of the 17 Eurozone Members must make to it. The ESM Treaty provides that the fund may be increased later by agreement and there is already talk of increasing it. Ireland must contribute €11 billion to it “irrevocably and unconditionally” in various forms of capital.

The Dáil will need to approve this in order to implement the ESM Treaty into Irish domestic law.

The ESM Treaty is to come into force once it is ratified by signatories representing 90% of the initial capital of the fund, so that Ireland has no veto on it.

The preamble to the ESM Treaty states that it is agreed that money from the permanent ESM fund will only be given to Eurozone States which have ratified the later “Fiscal Compact Treaty” and its permanent balanced budget rule or “debt brake” and that the two treaties are complementary. (2)

There are some important preconditions for the establishment of a permanent stability mechanism. In particular, the condition that the ESM can only be activated “if indispensable to safeguard the stability of the euro area as a whole” and there is strict conditionality attached to assistance.

ESM financial assistance will only be activated by a request from a euro area country. Following this request, the European Commission, together with the IMF and in liaison with the ECB, will assess whether there is a risk to the financial stability of the euro area as a whole and will undertake a rigorous analysis of the sustainability of the public debt of the requesting country. If it is concluded that an adjustment programme can realistically restore the public debt to a sustainable path, the Commission, together with the IMF and in liaison with the ECB, will then assess the actual financing needs of the country concerned. On the basis of this assessment, an adjustment programme would be negotiated, the details of which will be laid down in a Memorandum of Understanding (MoU).

Compliance with the adjustment programme will be monitored and reported to the ECOFIN Council and the Board of Directors of the ESM. On the basis of this report, disbursement of further tranches of the loan would be decided. After the completion of the adjustment programme, the EU Council may decide, on the basis of a proposal from the Commission, to implement post-programme surveillance, which can be maintained for as long as a specified amount of the financial assistance has not been repaid. (5)

So what's the problem with it?

The ESM may therefore provide stability support on the basis of a strict conditionality, appropriate to the financial assistance instrument chosen if indispensable to safeguard the financial stability of the euro area as a whole and of its Member States.

As it states, this will be enacted to safeguard the financial stability as a whole and not for the common good and people of any of the nations.

This funding will be made available under strict conditionality.

Article 3...The purpose of the ESM shall be to mobilise funding and provide stability support under strict conditionality.

Article 13.3 The Board of Governors shall entrust the European Commission – in liaison with the ECB and, wherever possible, together with the IMF – with the task of negotiating, with the ESM Member concerned, a memorandum of understanding (MoU) detailing the conditionality attached to the financial assistance facility. The content of the MoU shall reflect the severity of the weaknesses to be addressed and the financial assistance instrument chosen. In parallel, the Managing Director of the ESM shall prepare a proposal for a financial assistance facility agreement, including the financial terms and conditions and the choice of instruments, to be adopted by the Board of Governors.

The MoU shall be fully consistent with the measures of economic policy coordination provided for in the TFEU, in particular with any act of European Union law, including any opinion, warning, recommendation or decision addressed to the ESM Member concerned.

This is where the Commission will be given its mandate to enforce budgetary measures.

Along with;

Article 5.. (g) to give a mandate to the European Commission to negotiate, in liaison with the ECB, the economic policy conditionality attached to each financial assistance, in accordance with Article 13(3).

Article 12.1..1. If indispensable to safeguard the financial stability of the euro area as a whole and of its Member States, the ESM may provide stability support to an ESM Member subject to strict conditionality, appropriate to the financial assistance instrument chosen. Such conditionality may range from a macro-economic adjustment programme to continuous respect of pre-established eligibility conditions.

Compliance with the conditionality will be monitered;

Article 13..7. The European Commission – in liaison with the ECB and, wherever possible, together with the IMF – shall be entrusted with monitoring compliance with the conditionality attached to the financial assistance facility. (5)

Questions Arising

What if the budgetary measures help the euro but damage the domestic economy?

What if the budgetary measures are not for the common good of the Irish People?

A major problem with this treaty is that along with our initial contribution of €11 billion, monies can be requested at any time and must be delivered within 7 days.

Article 8. 4. ESM Members hereby irrevocably and unconditionally undertake to provide their contribution to the authorised capital stock, in accordance with their contribution key in

Annex I.

They shall meet all capital calls on a timely basis in accordance with the terms set out in this Treaty.

and also;

Article 9..3. The Managing Director shall call authorised unpaid capital in a timely manner if needed to avoid the ESM being in default of any scheduled or other payment obligation due to ESM creditors. The Managing Director shall inform the Board of Directors and the Board of Governors of any such call. When a potential shortfall in ESM funds is detected, the Managing Director shall make such capital call(s) as soon as possible with a view to ensuring that the ESM shall have sufficient funds to meet payments due to creditors in full on their due date. ESM Members hereby irrevocably and unconditionally undertake to pay on demand any capital call made on them by the Managing Director pursuant to this paragraph, such demand to be paid within seven days of receipt.

(5)

Questions Arising

What if we do not have the money?

Where do we get the money from to fullfill our obligations?

Another disturbing factor of this treaty is accountability - there is none, in fact it is immune and inviolable!

It cannot be brought before a court. Its property, funding, assets, documents are immune from search, seizure or scrutiny, its documents and building are inviolable. It is free from any requirement to be authorised, regulated, free from all restrictions, regulations and controls.

All staff members will be immune from legal proceedings with respect to their official work.

ARTICLE 32 Legal status, privileges and immunities

1. To enable the ESM to fulfil its purpose, the legal status and the privileges and immunities set out in this Article shall be accorded to the ESM in the territory of each ESM Member. The ESM shall endeavour to obtain recognition of its legal status and of its privileges and immunities in other territories in which it performs functions or holds assets.

2. The ESM shall have full legal personality; it shall have full legal capacity to: (a) acquire and dispose of movable and immovable property; (b) contract; (c) be a party to legal proceedings; and (d) enter into a headquarter agreement and/or protocols as necessary for ensuring that its legal status and its privileges and immunities are recognised and enforced.

3. The ESM, its property, funding and assets, wherever located and by whomsoever held, shall enjoy immunity from every form of judicial process except to the extent that the ESM expressly waives its immunity for the purpose of any proceedings or by the terms of any contract, including the documentation of the funding instruments.

4. The property, funding and assets of the ESM shall, wherever located and by whomsoever held, be immune from search, requisition, confiscation, expropriation or any other form of seizure, taking or foreclosure by executive, judicial, administrative or legislative action.

5. The archives of the ESM and all documents belonging to the ESM or held by it, shall be inviolable.

6. The premises of the ESM shall be inviolable.

7. The official communications of the ESM shall be accorded by each ESM Member and by each state which has recognised the legal status and the privileges and immunities of the ESM, the same treatment as it accords to the official communications of an ESM Member.

8. To the extent necessary to carry out the activities provided for in this Treaty, all property, funding and assets of the ESM shall be free from restrictions, regulations, controls and moratoria of any nature.

9. The ESM shall be exempted from any requirement to be authorised or licensed as a credit institution, investment services provider or other authorised licensed or regulated entity under the laws of each ESM Member.

ARTICLE 35 Immunities of persons

1. In the interest of the ESM, the Chairperson of the Board of Governors, Governors, alternate Governors, Directors, alternate Directors, as well as the Managing Director and other staff members shall be immune from legal proceedings with respect to acts performed by them in their official capacity and shall enjoy inviolability in respect of their official papers and documents. (5)

Questions Arising

Is it sensible to give such control over a nation's budget to an unaccountable and inviolable organisation?

Is it Constitutional?

Before discussing the ins and outs of whether individual aspects or indeed the treaty as a whole is in conflict with our constitution and therefore would require a referendum, we should consider 'precedence'.

Crotty v. An Taoiseach 1987 established that significant changes to European Union treaties required an amendment to the constitution before they could be ratified by the state, thereby requiring a referendum.

The words of Mr. Justice Hederman in relation to the ratification of the Single European Act:

The court held that it is not within the competence of the Government, or indeed of the Oireachtas, to free themselves from the restraints of the Constitution, or to transfer their powers to other bodies, unless expressly empowered so to do by the Constitution. They are both creatures of the Constitution and are not empowered to act free from the restraints of the Constitution.

(9 April 1987, Supreme Court 1986 No. 12036P):

“It appears to me that the essential point at issue is whether the State can by any act on the part of its various organs of government enter into binding agreements with other states, or groups of states, to subordinate, or to submit, the exercise of the powers bestowed by the Constitution to the advice or interests of other states, as distinct from electing from time to time to pursue its own particular policies in union or in concert with other states in their pursuit of their own similar or even identical policies.

The States organs cannot contract to exercise in a particular procedure their policy-making roles or in any way to fetter powers bestowed unfettered by the Constitution. They are the guardians of these powers not the disposers of them.”

The court held that it is not within the competence of the Government, or indeed of the Oireachtas, to free themselves from the restraints of the Constitution, or to transfer their powers to other bodies, unless expressly empowered so to do by the Constitution.

Mr Justice Walsh reminded us:

Article 6 of the Constitution refers to the powers of government as being derived from the people, whose right it is to designate the rulers of the State and, in final appeal, to decide all questions of national policy, according to the requirements of the common good.

It must follow therefore that all the powers of government are to be exercised according to the requirements of the common good. The essential nature of sovereignty is the right to say Yes or to say No. (6)

Questions Arising

Does the ESM treaty transfer governmental powers to other bodies?

Is the state entering into binding agreements which will subordinate the powers of the constitution to the interests of other states??

Is the state disposing of its powers which have been bestowed upon them by the Constitution?

Will the ESM be exercised according to the common good of the Irish people or for the 'Euro'?

Will we be able to exercise our sovereign right to say yes or no?

Is it Constitutional?

Confer: to grant or bestow.

Power: the ability or capacity to do something or act in a particular way--, the capacity or ability to direct or influence the behaviour of others or the course of events: political or social authority or control, especially that exercised by a government.

Increase: become or make greater in size, amount, or degree.

Competence: the legal authority of a court or other body to deal with a particular matter:

Does the ESM grant or bestow the ability or capacity for political or social authority??

Does the ESM make greater the legal authority of another body to deal with particular matters?

The answering being Yes to either question would mean we need a referendum on the ESM.

Considering the above, we need to consider, does the ESM confer more power to the EU, is it repugnant to any of the articles within the Constitution?

We would assert that the passing of this Bill/treaty will prevent Ireland as a democratic constitutional republic under;

Article 1; The Irish nation hereby affirms its inalienable, indefeasible, and sovereign right to choose its own form of Government, to determine its relations with other nations, and to develop its life, political, economic and cultural, in accordance with its own genius and traditions.

The Irish nation will not be determining and developing its economy in accordance with its own genius and traditions if subject to the conditionalities of the ESM which would be beyond its control.

Article 5; Ireland is a sovereign, independent, democratic state.

By handing over economic control of the nations finances in adherence to the conditionality, we also hand over our economic sovereignty.

Article 6. 1.; All powers of government, legislative, executive and judicial, derive, under God, from the people, whose right it is to designate the rulers of the State and, in final appeal, to decide all questions of national policy, according to the requirements of the common good.

1. The ESM hands over the power of the people to decide questions of national economic policy in accordance with the common good to an undemocratically elected organisation that is free from scrutiny and accountability.

Article 6.2.; These powers of government are exercisable only by or on the authority of the organs of State established by this Constitution.

1. The ESM organisation does not have the authority established by the Constitution to exercise such controls.

By passing the ESM through the Dáil without referring to the people for referendum this would be in violation of

Article 15.4.1° The Oireachtas shall not enact any law which is in any respect repugnant to this Constitution or any provision thereof.

I would like to draw your particular attention to certain articles of the Treaty Establishing the European Stability Mechanism (ESM) presented in Brussels on July 11th 2011 which clearly show a loss of sovereignty to the people of Ireland should it be ratified:

ARTICLE 3 of the ESM whereby, 'The purpose of the ESM shall be to mobilise funding and provide financial assistance, under strict economic policy conditionality, to the benefit of ESM Members which are experiencing or are threatened by severe financing problems, if indispensable to safeguard the financial stability of the euro area as a whole.'

The strict economic policy conditionality in reality allows for 'handing over' economic sovereignty to Brussels repugnant to Articles 1, 5 and 6 of the Constitution.

ARTICLE 9, Capital calls

1. The Board of Governors may call in authorised unpaid capital at any time and set an appropriate period of time for its payment by the ESM Members.

2. The Board of Directors may call in authorised unpaid capital by simple majority decision to restore the level of paid-in capital if the amount of the latter is reduced by the absorption of losses below the level established in Article 8(2), as may be amended by the Board of Governors following the procedure provided for in Article 10, and set an appropriate period of time for its payment by the ESM Members.

3. The Managing Director shall call in authorised unpaid capital in a timely manner if needed to avoid the ESM being in default of any scheduled or other payment obligation due to ESM creditors. The Managing Director shall inform the Board of Directors and the Board of Governors of any such call. When a potential shortfall in ESM funds is detected, the Managing Director shall make such capital call(s) as soon as possible with a view to ensuring that the ESM shall have sufficient funds to meet payments due to creditors in full on their due date. ESM Members hereby irrevocably and unconditionally undertake to pay on demand any capital call made on them by the Managing Director pursuant to this paragraph, such demand to be paid within seven days of receipt. (5)

Treaty on Stability, Coordination and Governance in the Economic

and Monetary Union (Fiscal Treaty)

The Fiscal Compact (formally, the Treaty on Stability, Coordination and Governance in the Economic and Monetary Union; also called the Fiscal Stability Treaty) is an intergovernmental treaty that was finalised on 30 January 2012. All member states of the European Union (EU) signed the treaty on 2 March 2012 except the Czech Republic and the United Kingdom. The treaty will enter into force on 1 January 2013, if at that time 12 of the 17 members of the euro area have ratified it. Once a country has ratified the Treaty it has another year, until 1 January 2014, to implement a balanced budget rule in their binding legislation.

On 28 February 2012, following the advice of the Attorney General Máire Whelan, the Irish Government announced that Ireland would hold a referendum on the Compact.

It was agreed to put strict caps on government spending and borrowing, with penalties for those countries who violate the limits.

Only countries with such rule in their legal code by 1 March 2013 will be eligible to apply for bailout money from the European Stability Mechanism (ESM). The aim is to incorporate it into EU law within five years of its entry into force. (7)

The fiscal pact contains the following rules:

General government budgets shall be balanced or in surplus. The annual structural deficit must not exceed 0.5% of nominal GDP. Countries with government debt levels significantly below 60 % and where risks in terms of long-term sustainability of public finances are low, can reach a structural deficit of at most 1.0 % of GDP.

EU's highest court will be able to fine a country that does not adopt a standardised balanced budget rule in its constitution - with a penalty equivalent to up to 0.1% of GDP. The money goes either to the ESM (if a Euro country is fined) or to the general EU budget (in case of fines imposed on non-eurozone signatories). (11)

At the moment only four EU countries have a deficit below the magic threshold (Luxembourg, Finland, Sweden and Estonia.

If you are in financial trouble you will be fined to 0.1 % of GDP if the national budget are not in balance or surplus.

The Department of Finance estimates that in 2015, Ireland will have a strucutral deficit of 3.7%. Bringing that down to 0.5% would mean €5.7 billion worth of extra cuts. (8)

Ireland's debt to GDP ratio is likely to be around 120% in 2015 when we exit the bailout. Reducing the debt ratio by one twentieth per year will therefore mean reducing it by 3% of GDP per year. Without significant economic growth, that means paying back €4.5 billion per year in principal to the bondholders on top of the €9 billion a year we will be paying in interest rates. This debt will only be paid back on the basis of yet more savage austerity imposed on working people, which will in turn mean a worsening of the crisis. (9)

Such a rule will also be introduced in Member States' national legal systems at constitutional or equivalent level. The rule will contain an automatic correction mechanism that shall be triggered in the event of deviation. All signing parties recognise the jurisdiction of the Court of Justice to verify the transposition of this rule at national level.(11)

This enshrines the 'automatic debt brake' in our legal system which will have a number of consequences, one being that austerity measures will be legally automatically introduced and also worryingly will also mean that engaging in expansionary fiscal policy will be effectively made illegal. This is not only fundamentally undemocratic, by tying the hands of future governments to continue the same economic policies and removing the right of people to elect a government with socialist or even Keynesian economic policies, but it is also bad economics from the point of view of ordinary people across Europe.

While it is the case that often achieving a structural balance would be a worthwhile aim, it also often makes sense for a state to engage in borrowing and deficit spending in order to create employment and develop the economy. (10)

Member States whose government debt exceeds the 60% reference level shall reduce it at an average rate of one twentieth per year as a benchmark.(11)

More austerity with more money being taken from the budget.

Member States in Excessive Deficit Procedure shall submit to the Commission and the Council for endorsement, an economic partnership programme detailing the necessary structural reforms to ensure an effectively durable correction of excessive deficits. The implementation of the programme, and the yearly budgetary plans consistent with it, will be monitored by the Commission and the Council.

A mechanism will be put in place for the ex-ante reporting by Member States of their national debt issuance plans.

Member States agree to take the necessary actions and measures, "which are essential to the good functioning of the euro area in pursuit of the objectives of fostering competitiveness, promoting employment, contributing further to the sustainability of public finances and reinforcing financial stability." They also ensure that all major economic policy reforms that they plan to undertake will be discussed ex-ante and, where appropriate, coordinated among themselves and with the institutions of the European Union.(11)

These actions will be for the benefit of the euro and not of the people of an individual nation, overseen by an unelected and inviolable, immune from any investigation, organisation.

The Member States whose currency is the euro may establish a stability mechanism to be activated if indispensable to safeguard the stability of the euro area as a whole. The granting of any required financial assistance under the mechanism will be made subject to strict conditionality.” (6)

The implementation of the programme, and the yearly budgetary plans consistent with it, will be monitored by the European Commission and by the Council. As soon as a Member State is recognised to be in breach of the 3% ceiling, the Commission submits a proposal of counter-measures, concerning in particular the nature, the size and the time-frame of the corrective action to be undertaken, while taking into consideration country-specific sustainability risks. Progress towards and respect of the medium-term objective shall be evaluated on the basis of an overall assessment with the structural balance as a reference, including an analysis of expenditure net of discretionary revenue measures. A qualified majority of Member States may reject these proposals. (7)

Ireland however will only have 1.6% of the vote.

The Economics, In Ireland's best Interest ?

Would the ESM and Fiscal Compact have prevented the recession?

Not according to the Economist: The pact’s rigidity would make recessions worse, and the new fiscal rule would not have kept Ireland or Spain out of trouble. (12)

Not according to the Davy Report (Bloomberg: Conall Mac Coille, Chief economist): The fiscal compact would have had no bearing on the collapse in Ireland's public finances had it been adopted at the inception of the euro. (13)

Would it improve the situation now?

Not according to the Economist: If private investors aren't taking losses, then other governments are stepping in to make good on obligations. That, in turn, will worsen their fiscal outlook. (14)

Not according to Paul De Grauwe (Centre for European Policy Studies Brussels): The ESM will apply a relatively high interest rate, countries that apply for financing will be subjected to a tough budgetary austerity program. Thus, with each recession, countries will be forced to reduce spending and to increase taxes. Investors who anticipate this will raise the interest rate on government bonds, thereby making the recession worse. (15)

Not according to Constantin Gurdgiev, Economist: There is nothing within the Pact that would facilitate either Portuguese or Irish economic stabilization and recovery. When it comes to dealing with the current crisis, the new Pact contains no tools for achieving structural reforms required to arrive at sustainable public finances. No country has been successful in restoring fiscal and external balances after a decade of twin deficits. (16)

And what about the future, will it solve the crisis?

Not according to the Davy Report (Bloomberg: Conall Mac Coille, Chief economist): Markets are unlikely to be reassured by a target that cannot be independently verified or agreed upon by official institutions. (13)

Not according to Paul De Grauwe (Centre for European Policy Studies Brussels): Will the establishment of the ESM shield the Eurozone from future crises? My answer is unambiguous. It will not. In fact it is worse than that. Some of the features that have been introduced in the functioning of the ESM will make it more difficult for a number of countries, in particular Ireland, to attract funds in private markets. These features will have the effect of increasing rather than reducing volatility in the financial markets. (15)

Not according to Constantin Gurdgiev, Economist: In medical analogy terms, this week’s Fiscal Pact signed by the 25 EU Member States, is equivalent to a misdiagnosed patient (the euro area economy) receiving a potent cocktail of misprescribed medicines.

In other words, the Fiscal Pact is neither a necessary, nor a sufficient solution to the ongoing crisis of the euro area insolvency. Moreover, it saddles the euro area with a choice of only two equally unpalatable alternatives. The first choice is compliance with the Pact that will lead to a situation whereby a one-policy-fits-all monetary framework will be coupled with an equally mismatched one-policy-fits-all fiscal framework. The second choice is business as usual, with continued reckless borrowing, internal and external imbalances and ever deepening links between the sovereign finances, the ECB and the banking sector balance sheets. In other words, there is a choice of either pushing Euro area down the deflationary, stagnation-inducing deleveraging spiral, or leaving it in the current modus operandi of reckless borrowing. Crucially, the idea of the Fiscal Pact as a tool for resolving the structural crisis faced by the Euro area is equivalent to doing more of the same and expecting a different outcome. Both alternatives are internecine for Ireland, and both increase the probability of an eventual collapse of the euro over the next 5-10 years. (16)

What about the people? Will the most vulnerable be protected?

Not according to Paul De Grauwe (Centre for European Policy Studies Brussels); The new financing mechanism that is being set up in the Eurozone will rob countries of their capacity to protect those hit by the recession. This is a major setback that will reduce the social and political basis that is needed to keep the Eurozone alive. (15)

Not according to the Economist; If it grows at a depressed pace or declines, ask who is taking the big real losses. Governments are trying to force losses onto households in order to avoid a financial blow-up. (17)

Will it benefit Ireland economically?

Not according to the Economist; Countries now targeted by markets to reduce government spending and raise taxes have been thrown into recession and are falling short of targeted deficit reduction. The 'Fiscal Compact' treaty would penalise this deficit to the tune of 1%of GDP, causing further economic pain. (18)

Not according to Constantin Gurdgiev, Economist; Ireland will be one of the worst impacted economies in the group. In 2012, Ireland is forecast to post a structural deficit in excess of 5.5% of potential GDP. To cut our structural deficit to 0.5% will require reducing annual aggregate demand in the economy by some €7-8 billion in today’s terms. Debt reductions over the period envisioned within the pact will take an additional €12 billion annually. For an economy with huge private sector debt overhang, paying some 12% of its GDP annually to adhere to the Fiscal Pact is a hefty bill on top of the already massive interest bill on public debt.

The Department of Finance estimates that in 2015, Ireland will have a structural deficit of 3.7%. Bringing that down to 0.5% would mean €5.7 billion worth of extra cuts.

Constantin Gurdgiev, Economist; In short, the Pact our Government so eagerly subscribed to is at the very best a continuation of the status quo. At its worst, Ireland and other member states of the Euro are now participants to a fiscal suicide pact, having previously signed up to a monetary straightjacket as well. (16)

Wynne Godley: If a country or region has no power to devalue, and if it is not the beneficiary of a system of fiscal equalisation, then there is nothing to stop it suffering a process of cumulative and terminal decline leading, in the end, to emigration as the only alternative to poverty or starvation. (19)

David Mc Williams:

The theory of “internal devaluation” says that the Irish economy and workforce are so flexible that we will all take dramatic paycuts, this will drive down wages and we will become competitive this way. Because we have no exchange rate and are members of the euro, we will devalue by cannibalising our own wages — but according to the present policy, even at these much lower wages we will be able to service the huge debts built up in the credit bubble. How is that possible? Well, it is not.

There is a reason why no economy in the world has ever emerged from a recession like ours without changing its exchange rate. The reason is that it simply can’t be done. There is no evidence anywhere, ever, that shows that a country can operate a successful “internal devaluation” — particularly an economy carrying as much debt as we have.

It is not that the policy of internal devaluation is not working, it can’t work. It has never worked anywhere, ever. (20)

Conclusions

It is the sovereign right of the Irish people to make an informed decision and have their say as to whether we wish to confer more powers to the EU. This means we are entitled to consider all aspects of this arrangement before any ratification by the government.

It is a complex arrangement involving the Amendment 136 and two treaties but as each is interlinked and empowers the other, they cannot be taken separately and must be put to the people for their consideration in their entirety. Anything less would be undemocratic.

References

1. First Amendment? The Treaty Change to Facilitate the European Stability Mechanism by Dr. Gavin Barrett

2. http://nationalplatform.org/2012/02/28/two-steps-to-a-f...-two/

3. http://eutopialaw.com/2012/02/21/responding-to-the-econ...-age/

4. http://www.economist.com/blogs/freeexchange/2012/02/eur...anism

5. The European Stability Mechanism, http://www.ecb.int/pub/pdf/other/art2_mb201107en_pp71-8...n.pdf

6. http://www.people.ie/eu/esmref2.pdf

7. Wikipedia

8. http://notesonthefront.typepad.com/politicaleconomy/201....html)

9. (http://brianmlucey.wordpress.com/2012/02/04/the-fiscal-...ible/)

10. (http://socialistparty.net/campaigns-issues/34-campaigns...reaty)

11. TREATY ON STABILITY, COORDINATION AND GOVERNANCE IN THE ECONOMIC AND MONETARY UNION BETWEEN, http://european-council.europa.eu/media/639235/st00tscg...2.pdf

12. http://www.economist.com/node/21541859

13. Davy Report (Bloomberg: Conall Mac Coille, Chief economist)

14. http://www.economist.com/blogs/freeexchange/2011/12/eur...sis-2

15. http://www.irisheconomy.ie/index.php/2011/04/17/paul-de...10186

16. http://trueeconomics.blogspot.com/2012/02/622012-fiscal....html

17. http://www.economist.com/blogs/freeexchange/2012/01/eur...risis

18. http://www.economist.com/blogs/freeexchange/2012/01/eur...risis

19. http://www.levyinstitute.org/publications/?docid=1493

20. http://www.davidmcwilliams.ie/2011/12/28/leaving-the-eu...ption

Further Reading

1. DECISIONS EUROPEAN COUNCIL DECISION of 25 March 2011, amending Article 136 of the Treaty on the Functioning of the European Union with regard to a stability mechanism for Member States whose currency is the euro (2011/199/EU), http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=O...3APDF

2. DRAFT EUROPEAN COUNCIL DECISION of … amending Article 136 of the Treaty on the Functioning of the European Union with regard to a stability mechanism for Member States whose currency is the euro

http://www.consilium.europa.eu/uedocs/cms_data/docs/pre...8.pdf

3. The European Treaty Amendment for the Creation of a Financial Stability Mechanism Swedish Institute for European Policy Studies

http://www.eui.eu/Projects/EUDO-Institutions/Documents/...a.pdf

4. TREATY ESTABLISHING THE EUROPEAN STABILITY MECHANISM

http://www.european-council.europa.eu/media/582311/05-t...2.pdf

5. TREATY ON STABILITY, COORDINATION AND GOVERNANCE IN THE ECONOMIC AND MONETARY UNION BETWEEN

http://european-council.europa.eu/media/639235/st00tscg...2.pdf

![]() The Fiscal Treaty document

0.05 Mb

The Fiscal Treaty document

0.05 Mb