North Korea Increases Aid to Russia, Mos... Tue Nov 19, 2024 12:29 | Marko Marjanovi?

North Korea Increases Aid to Russia, Mos... Tue Nov 19, 2024 12:29 | Marko Marjanovi?

Trump Assembles a War Cabinet Sat Nov 16, 2024 10:29 | Marko Marjanovi?

Trump Assembles a War Cabinet Sat Nov 16, 2024 10:29 | Marko Marjanovi?

Slavgrinder Ramps Up Into Overdrive Tue Nov 12, 2024 10:29 | Marko Marjanovi?

Slavgrinder Ramps Up Into Overdrive Tue Nov 12, 2024 10:29 | Marko Marjanovi?

?Existential? Culling to Continue on Com... Mon Nov 11, 2024 10:28 | Marko Marjanovi?

?Existential? Culling to Continue on Com... Mon Nov 11, 2024 10:28 | Marko Marjanovi?

US to Deploy Military Contractors to Ukr... Sun Nov 10, 2024 02:37 | Field Empty

US to Deploy Military Contractors to Ukr... Sun Nov 10, 2024 02:37 | Field Empty

Anti-Empire >>

Indymedia Ireland is a volunteer-run non-commercial open publishing website for local and international news, opinion & analysis, press releases and events. Its main objective is to enable the public to participate in reporting and analysis of the news and other important events and aspects of our daily lives and thereby give a voice to people.

Fraud and mismanagement at University College Cork Thu Aug 28, 2025 18:30 | Calli Morganite

Fraud and mismanagement at University College Cork Thu Aug 28, 2025 18:30 | Calli Morganite

UCC has paid huge sums to a criminal professor

This story is not for republication. I bear responsibility for the things I write. I have read the guidelines and understand that I must not write anything untrue, and I won't.

This is a public interest story about a complete failure of governance and management at UCC.

Deliberate Design Flaw In ChatGPT-5 Sun Aug 17, 2025 08:04 | Mind Agent

Deliberate Design Flaw In ChatGPT-5 Sun Aug 17, 2025 08:04 | Mind Agent

Socratic Dialog Between ChatGPT-5 and Mind Agent Reveals Fatal and Deliberate 'Design by Construction' Flaw

This design flaw in ChatGPT-5's default epistemic mode subverts what the much touted ChatGPT-5 can do... so long as the flaw is not tickled, any usage should be fine---The epistemological question is: how would anyone in the public, includes you reading this (since no one is all knowing), in an unfamiliar domain know whether or not the flaw has been tickled when seeking information or understanding of a domain without prior knowledge of that domain???!

This analysis is a pretty unique and significant contribution to the space of empirical evaluation of LLMs that exist in AI public world... at least thus far, as far as I am aware! For what it's worth--as if anyone in the ChatGPT universe cares as they pile up on using the "PhD level scholar in your pocket".

According to GPT-5, and according to my tests, this flaw exists in all LLMs... What is revealing is the deduction GPT-5 made: Why ?design choice? starts looking like ?deliberate flaw?.

People are paying $200 a month to not just ChatGPT, but all major LLMs have similar Pro pricing! I bet they, like the normal user of free ChatGPT, stay in LLM's default mode where the flaw manifests itself. As it did in this evaluation.

AI Reach: Gemini Reasoning Question of God Sat Aug 02, 2025 20:00 | Mind Agent

AI Reach: Gemini Reasoning Question of God Sat Aug 02, 2025 20:00 | Mind Agent

Evaluating Semantic Reasoning Capability of AI Chatbot on Ontologically Deep Abstract (bias neutral) Thought

I have been evaluating AI Chatbot agents for their epistemic limits over the past two months, and have tested all major AI Agents, ChatGPT, Grok, Claude, Perplexity, and DeepSeek, for their epistemic limits and their negative impact as information gate-keepers.... Today I decided to test for how AI could be the boon for humanity in other positive areas, such as in completely abstract realms, such as metaphysical thought. Meaning, I wanted to test the LLMs for Positives beyond what most researchers benchmark these for, or have expressed in the approx. 2500 Turing tests in Humanity?s Last Exam.. And I chose as my first candidate, Google DeepMind's Gemini as I had not evaluated it before on anything.

Israeli Human Rights Group B'Tselem finally Admits It is Genocide releasing Our Genocide report Fri Aug 01, 2025 23:54 | 1 of indy

Israeli Human Rights Group B'Tselem finally Admits It is Genocide releasing Our Genocide report Fri Aug 01, 2025 23:54 | 1 of indy

We have all known it for over 2 years that it is a genocide in Gaza

Israeli human rights group B'Tselem has finally admitted what everyone else outside Israel has known for two years is that the Israeli state is carrying out a genocide in Gaza

Western governments like the USA are complicit in it as they have been supplying the huge bombs and missiles used by Israel and dropped on innocent civilians in Gaza. One phone call from the USA regime could have ended it at any point. However many other countries are complicity with their tacit approval and neighboring Arab countries have been pretty spinless too in their support

With the release of this report titled: Our Genocide -there is a good chance this will make it okay for more people within Israel itself to speak out and do something about it despite the fact that many there are actually in support of the Gaza

China?s CITY WIDE CASH SEIZURES Begin ? ATMs Frozen, Digital Yuan FORCED Overnight Wed Jul 30, 2025 21:40 | 1 of indy

China?s CITY WIDE CASH SEIZURES Begin ? ATMs Frozen, Digital Yuan FORCED Overnight Wed Jul 30, 2025 21:40 | 1 of indy

This story is unverified but it is very instructive of what will happen when cash is removed

THIS STORY IS UNVERIFIED BUT PLEASE WATCH THE VIDEO OR READ THE TRANSCRIPT AS IT GIVES AN VERY GOOD IDEA OF WHAT A CASHLESS SOCIETY WILL LOOK LIKE. And it ain't pretty

A single video report has come out of China claiming China's biggest cities are now cashless, not by choice, but by force. The report goes on to claim ATMs have gone dark, vaults are being emptied. And overnight (July 20 into 21), the digital yuan is the only currency allowed.

The Saker >>

Will Labour Ban Christmas Carols Next? Wed Dec 24, 2025 17:00 | Julian Mann

Will Labour Ban Christmas Carols Next? Wed Dec 24, 2025 17:00 | Julian Mann

If Christmas songs fall foul of Labour's 'banter ban', Christmas carols ? with their 'offensive' assertions of the divinity of Christ that are deemed blasphemous by Islam ? are even more likely to, says Julian Mann.

The post Will Labour Ban Christmas Carols Next? appeared first on The Daily Sceptic.

Starmer to Push Britain into Stricter Net Zero Targets Under EU Deal Wed Dec 24, 2025 15:26 | Will Jones

Starmer to Push Britain into Stricter Net Zero Targets Under EU Deal Wed Dec 24, 2025 15:26 | Will Jones

Keir Starmer is preparing to tie Britain to the EU's Net Zero plans in a move that would impose radically stricter 'green' energy targets on homes and businesses, leading to further deindustrialisation and impoverishment.

The post Starmer to Push Britain into Stricter Net Zero Targets Under EU Deal appeared first on The Daily Sceptic.

A Crappy Christmas from Anglian Water Wed Dec 24, 2025 13:17 | Mike Wells

A Crappy Christmas from Anglian Water Wed Dec 24, 2025 13:17 | Mike Wells

Dumping of sewage into rivers is supposed to happen only 'exceptionally'. But in Odell it occurred for over a third of the year. In Bedford it may be worse ? but the monitoring equipment is broken, says Mike Wells.

The post A Crappy Christmas from Anglian Water appeared first on The Daily Sceptic.

Trump Bans Two Britons From US for Curbing Free Speech Wed Dec 24, 2025 11:15 | Will Jones

Trump Bans Two Britons From US for Curbing Free Speech Wed Dec 24, 2025 11:15 | Will Jones

Trump will deport Imran Ahmed, the Chief Executive of the Centre for Countering Digital Hate, and ban from the US Thierry Breton, the pro-censorship former EU commissioner, along with another Brit for curbing free speech.

The post Trump Bans Two Britons From US for Curbing Free Speech appeared first on The Daily Sceptic.

The Festive Period is a Reminder that Enshittification is Inevitable ? But There is Hope Wed Dec 24, 2025 09:00 | Joanna Gray

The Festive Period is a Reminder that Enshittification is Inevitable ? But There is Hope Wed Dec 24, 2025 09:00 | Joanna Gray

As Britain continues its slide into social and cultural decay, the festive period is a time to remember that, while enshittification is inevitable, there is hope while we can remember what is good, says Joanna Gray.

The post The Festive Period is a Reminder that Enshittification is Inevitable ? But There is Hope appeared first on The Daily Sceptic.

Lockdown Skeptics >>

Voltaire, international edition

Will intergovernmental institutions withstand the end of the "American Empire"?,... Sat Apr 05, 2025 07:15 | en

Will intergovernmental institutions withstand the end of the "American Empire"?,... Sat Apr 05, 2025 07:15 | en

Voltaire, International Newsletter N?127 Sat Apr 05, 2025 06:38 | en

Voltaire, International Newsletter N?127 Sat Apr 05, 2025 06:38 | en

Disintegration of Western democracy begins in France Sat Apr 05, 2025 06:00 | en

Disintegration of Western democracy begins in France Sat Apr 05, 2025 06:00 | en

Voltaire, International Newsletter N?126 Fri Mar 28, 2025 11:39 | en

Voltaire, International Newsletter N?126 Fri Mar 28, 2025 11:39 | en

The International Conference on Combating Anti-Semitism by Amichai Chikli and Na... Fri Mar 28, 2025 11:31 | en

The International Conference on Combating Anti-Semitism by Amichai Chikli and Na... Fri Mar 28, 2025 11:31 | en

Voltaire Network >>

national |

crime and justice |

feature

national |

crime and justice |

feature

Wednesday September 19, 2012 23:33

Wednesday September 19, 2012 23:33 by WSM

by WSM

printable version

printable version

Digg this

Digg this del.icio.us

del.icio.us Furl

Furl Reddit

Reddit Technorati

Technorati Facebook

Facebook Gab

Gab Twitter

Twitter

View Comments Titles Only

save preference

Comments (3 of 3)

Jump To Comment: 1 2 3' “This report makes the valuable point that leaving the resources in the hands of private corporations gets us nowhere – we need to assume public ownership of these resources and then decide, democratically, how, if at all, they are to be made use of.” '

"The solution, however, is a simple one. Mr Rabbitte should tell the oil companies he is tearing up all existing agreements and seek new licensing terms similar to those that other oil-rich countries, like Norway, demand and get." ………Shell 2 Sea

The above statements from S2S need to be read in conjunction with what the government is saying about Ireland having lost its economic independence .

“We will not cease in our painstaking, quiet but persuasive endeavours until Ireland has re-established the economic independence, so precious, so hard-won, which is its right and its due.”……… Enda Kenny

“We have lost our economic sovereignty,” ……..Ruari Quinn .

Socialists used to talk about public control and nationalizing essential industries and financial institutions. In the globalized economy , how is it possible for national governments to control resources that have been signed over to multinational corporations ? If a future Irish government did pass a bill to nationalize the Corrib gasfields , would Shell allow what they consider to be their property being taken away from them by the government of an insolvent nation ?

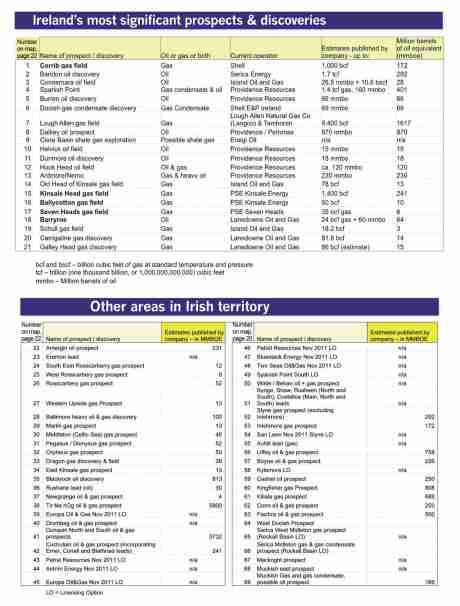

The first thing I notice about this report is that there is no mention of the Fastnet announcement from last summer. The stock market announcement claimed that they had found 15bn barrels derisked. So that's another $1.5 trillion.

http://www.independent.ie/business/irish/report-offers-....html

Strangely none of these companies are extracting oil yet despite the last 20 years of regular announcements of these 'prospects' and the remarkably generous tax regime. What could it be? Do these companies not want the money? Is there an Irish sea-going Loch Ness Monster?

The simple answer is that they have not yet found oil in commercial quantities. They hope to find oil and they want money from investors to explore for more so they issue these optimistic statements to the public that only a fool would take at face value. The two gas finds have been piddling - less than 1% of Norway's commercial gas fields for comparison.

The following comments are addressed at Hederman's series of articles about Irish oil and gas licensing and Shell and Corrib.

1. Shell has great engineering skills but terrible PR handling. The decision to make martyrs of the original ‘Rossport 5′ was a huge own-goal. At Shell projects elsewhere like Brent Spar, similar mistakes were made in the past.

2. Shell failed to purchase local and national political support at an early stage. All infrastructure projects require this activity from Telecoms to Roads, to Energy. Political support is cheap to purchase in Ireland. A discreet method is to throw 5K at each of 100 election candidates, thus putting the contributions below the SIPO declaration radar, yet making a substantial contribution to a party. Now you own the party hierarchy for just a half mil. Usually local support is obtained by paying off the tribal elders and allowing community peer pressure to do the rest. None of these actions are illegal. A few million at the start to buy locals new houses, send kids to college, new GAA facilities – all the minibribes they’re doing now would surely have avoided all the cost and delay. Poor strategic planning.

3. Statoil’s reputation seems to have come off unscathed with Fintan O’Toole even suggesting that Ireland should start a joint venture with Norway rather than allow big bad oil to rob us. Did he not know that Statoil is mostly owned by Norway or that Statoil was a major JV partner in Corrib?

4. Regarding the zero royalty rates. I would see this as OK so long as there is some upper bound on what can be extracted. Last time I checked, France and Spain also had zero royalty and I believe Norway started this way to attract drilling. The idea is to lure companies to perform some exploration and drilling and build some infrastructure, then levy higher tax rates on later licences, should anything be found. Corrib and Kinslae are very small finds.

5. For any criticism to be valid, you need to provide an alternative policy. You have suggested (I think) free state equity in projects or else introducing a royalty or more stringent taxation.

6. Regarding equity. Equity is usually worth less than a fixed share of profits for a resource extraction project (unless the company’s shareholders are embezzling the capital). Consider an equity holding in the Corrib Field. The shareholders may be liable for additional capital requests as needed either by dilution of shareholding or debt. Ultimately, what do the shareholders gain for their time and money invested? Profits. The state will obtain a profit share without risk capital.

7. Regarding higher taxes/ royalties.I think you understand that additional taxes for future projects in Ireland would likely result in no further exploration. The oil/gas would be left in the ground. In a way this is good: after all, oil and gas are finite and history suggests that prices will rise and that extraction techniques will improve. On the other hand, there is the hope that the initial low tax discoveries will be the catalyst for a huge taxable find. Is there democratic public support for a policy of ‘leave it in the ground’? There is not.

8. I think you also understand that existing contracts cannot be retrospectively altered within Irish or EU or EFTA law.

9. Regarding Ray Burke etc. Laying the blame at RB’s door is unconvincing even if it is an attractive narrative for the public. Many governments have come and gone since Ray Burke in the 1980s and none have chosen to alter the licensing regime (apart from Eamonn Ryan who brought in the 15% surtax). The licensing terms in operation are not out of step with other territories that have had such poor exploration history as Ireland. Your graph omits these countries.

10. Regarding the idea that corporate profits are elusive and untaxable. It is naive to think that profits can simply be magicked away. Over €4bn was paid in corporate taxation in Ireland last year - none of it willingly. Gas and oil extraction is near impossible to hide and the wholesale price is well known. In other industries where the goods are less tangible and the pricing more opaque, there is more opportunity for creative accounting. The Corrib partners can legitimately complain that their profits have been reduced by the years of delay but it is also their own fault for failing to obtain political buy-in at an early stage and concentrating their efforts instead on the engineering problems. The regime of accelerated capital allowances is not unusual or restricted to resource extraction (eg you can get ACA for renewables and energy efficiency and even some real estate projects). ACA is not particularly costly, it just means the company gets its tax reliefs earlier. I doubt Shell/Statoil care much. Also I am assuming that you understand the concept of taxing profit rather than turnover. The state does not tax a plumber for the income earned to pay the cost of her tools.

11. Regarding the ultimate gain to the state from the project. You seem a little confused about the price of gas. Gas price for Corrib will be set by the UK NBP spot price. This is the alternative to buying gas from Corrib. spot price right now is around 78c/therm or €7.8bn for a 1tcf field. Of course the price of gas has varied wildly in the past. The estimates for the ultimate quantity of gas to be extracted are vague, the lifespan of the well is unknown. A lot depends on future shale gas discovery, LNG, price of oil, and so on. There is a lot of risk and uncertainty. if you put the costs at 2.8bn and assume that gas price remains constant for 20yrs then you have a 1.25bn profit for the state and 3.75bn for the investors, spread over that time. It’s not a lot of money given that gross state expenditure will probably exceed €2tn over that time. The big dream is that a really big find is made that contributes €1bn/year. Norway gets over €10bn/year from its oil and €18bn from its gas. Norway exports the equivalent of three entire Corrib fields each year. So you can see we are discussing relative crumbs compared to other countries. Even if Ireland seized the entire Corrib gas operation by force it might bring in €200mn a year or 0.3% of gross annual public expenditure. To seize foreign property would be unconstitutional and illegal at national and EU level and would naturally result in foreign sanctions that a trading nation could not avoid.

12. There are other benefits to the project. Most towns in Mayo now have gas and this part of the country will have this energy infrastructure when the Corrib gas runs out. Gas is a cleaner more plentiful fuel than oil and a benefit to have. There will be some local employment and economic activity. Gas is transported by pipe so you don’t get the heavy traffic during operation that you get with an oil refinery.

13. Regarding oil extraction direct to ship (FPSO) This is an expensive option compared to pipeline chosen for regions at war. You are onto something here because using an FPSO means that there is no pipeline hardware adding energy security for Ireland. The state should mandate a pipeline to shore as a planning condition. But in all honesty I think it’s a remote possibility that any company would consider FPSO in Ireland.

14. I expect you know that Providence’s claims are not credible. Their market cap is less than 0.5% of the value of the oil they claim to have found. The stock market does not believe them. Anyone who thinks otherwise is welcome to buy their shares. There have been no commercial oil finds to date in Irish waters but many media and stock market announcements.

15. Ireland may have a pot of gold but it has not been found yet and few are looking. Only one exploration licence was granted in 2009. Arguing about the tax rates when there are no players is probably a waste of time. Remember the state still spends up to 70bn per year and much of this is misdirected. I would be more interested in where this cash is being misallocated rather than chasing an illusory new revenue source.

There are good points made in the above comment but I tend not to agree with the main criticism which is that regarding oil finds and the claims of the various companies.

Referring to the spreadsheet attached in the main story, I noticed the following:

The Corrib Gas field which seems to be in similar depth of water as many of the other drill sites is commercial at a level of 1000 bcf which is equivalent of 172 Mboe. This sort of agrees with the Kinsale Gas field which was 1400 bcf and the two smaller nearby fields of Ballycotten (60 bcf) which is in production and the Seven Heads (35 bcf) . I believe the same rig platform is used for Ballycotten as for Kinsale indicating that the in-place infrastructure then makes it even more commerically viable to go after the smaller fields. I'm not clear whether Seven Heads in connected.

Either way the Barryroe oil field has been declared commerical and is marked as 1612 Mboe. This is a P10 estimate meaning it has a probability of 10% correct. The industry uses probabilities of 90%, 50% and 10% for reserve quotes (P90, P50 & P10) where the US SEC requires filing reserves under P10 which are generally very optimistic. Anyhow for the Barryroe estimate 1612 Mboe, if we even take 1/10th of this at 160 Mboe, it is still a very significant find and at say € 60 a barrel, that's worth €9.6 billion.

Then further down the sheet is the Schull (only 18bcf), Carrigaline and Galley Head when all these are added together will still amount to decent revenue for the owners, and the best part is the may be able to use the same infrastructure given they are so near each other and the Seven Heads. The other prospects yet to be drilled namely Middleton, Rosscarberry x3 and others between them are likely to contribute something to these finds.

Returning to the Corrib field, we have the Kylemore prospect which according to the reports indicate it is a similar sized field with up to 228 bcf which is about one fifth of Corrib, but with Corrib in place, the infrastructure costs will be largely be in place. One has to ask themselves why Shell have built such a large gas handling plant in Mayo. They clearly foresee that it will be used for longer than the lifetime of Corrib which if I recall is only about 10 years once production starts, so they are spending the money. Along the Porcupine Basis where Corrib is to the North, there are a string of prospects which Shell has clearly figured some of these will come through and it is likely. This is because when oil or gas is found and sometimes they are found together there tends to be a cluster of fields of varying size distribution in the area and it would be partially due to this type of knowledge and of course the favourable geology that many oil & gas companies are even willing to spend the money doing exploration drills.

One should recall that the Irish Marine Institute spent a number of years and quite a bit of money mapping the seabed all around Ireland a few years back and it is this data which is providing the basic geological information when no other data exists.

Continuing we also have the Bandon Oil discovery, estimate 292 Mboe. It is not clear whether this is a P10 or P50 figure. There is the Spanish Pt gas and oil. Gas estimate 1.4 tcf (or 1400 bcf) which if we assume a P50 estimate and mark it down to say 700 bcf is still on the scale of Corrib.

So without continuing further I think we can conclude the following which is partial agreement with the above but also in disagreement to its main points and these are:

1. There is very likely much hype from oil & gas companies to attract investors with talk of billions of barrels of oil and trillions of cubic feet of gas.

2. It is likely there will be no giant oil or gas wells -that is oil wells bigger than 1 billion barrels or for case more than say 2000 bcf. The figures thrown around in the press are usually P10 figures which are only 10% accurate but attention should be paid to P50 and if available P90 figures.

3. It is likely there will be many relatively small (that is on global scale) or relatively large on the Irish scale of oil and gas finds and indeed there are some already. Those that will go into production will attempt to use existing infrastructure such as that built for Corrib and for Kinsale & Seven Heads.

4. For areas requiring new infrastructure the oil finds would probably have to be around 100 Mboe and for gas as Corrib has proved 1000 bcf is more than enough

5. The combined output of all of these moderate sized oil and gas wells will add up to significant and steady income over the next decade or two for the companies concerned. The big question is whether the Irish people will get any of it.

The above comment tends to be dismissive of the article because it basically says there will be no huge finds and it is not worth worrying about the moderate stuff. It is worth worrying about the moderate stuff because it does add up over the long term and is particularly grating when the Irish people will get none of the benefit but will suffer any of the pollution consequences.