Trump hosts former head of Syrian Al-Qae... Tue Nov 11, 2025 22:01 | imc Trump hosts former head of Syrian Al-Qae... Tue Nov 11, 2025 22:01 | imc

Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark

Study of 1.7 Million Children: Heart Dam... Sat Nov 01, 2025 00:44 | imc Study of 1.7 Million Children: Heart Dam... Sat Nov 01, 2025 00:44 | imc

The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan

Top Scientists Confirm Covid Shots Cause... Sun Oct 05, 2025 21:31 | imc Top Scientists Confirm Covid Shots Cause... Sun Oct 05, 2025 21:31 | imc Anti-Empire >>

Indymedia Ireland is a volunteer-run non-commercial open publishing website for local and international news, opinion & analysis, press releases and events. Its main objective is to enable the public to participate in reporting and analysis of the news and other important events and aspects of our daily lives and thereby give a voice to people.

Trump hosts former head of Syrian Al-Qaeda Al-Jolani to the White House Tue Nov 11, 2025 22:01 | imc Trump hosts former head of Syrian Al-Qaeda Al-Jolani to the White House Tue Nov 11, 2025 22:01 | imc

Was that not what the War on Terror was about ?

Today things finally came full circle. It was Al-Qaeda that supposedly caused 9/11 and lead to the War on Terror but really War of Terror by the USA and lead directly to the deaths of millions through numerous wars in the Middle East.

And yet today the former head of Syrian Al-Qaeda, Al-Jolani was hosted in the White House by Trump. A surreal moment indeed.

In reality of course 9/11 was orchestrated by inside forces that wanted to launch the War of Terror and Al-Qaeda has been a wholly backed American tool ever since then.

Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark

That tree we got retained in 2007, is no more

2007

http://www.indymedia.ie/art...

2025

https://eplan.limerick.ie/i...

Study of 1.7 Million Children: Heart Damage Only Found in Covid-Vaxxed Kids Sat Nov 01, 2025 00:44 | imc Study of 1.7 Million Children: Heart Damage Only Found in Covid-Vaxxed Kids Sat Nov 01, 2025 00:44 | imc

A major study involving 1.7 million children has found that heart damage only appeared in children who had received Covid mRNA vaccines.

Not a single unvaccinated child in the group suffered from heart-related problems.

In addition, the researchers note zero children from the entire group, vaccinated or unvaccinated, died from COVID-19.

Furthermore, the study found that Covid shots offered the children very little protection from the virus, with many becoming infected after just 14 to 15 weeks of receiving an injection.

The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan

Disability Fine Lauder and Passive Income with Financial Gain as A Motive

Why not make money?

Top Scientists Confirm Covid Shots Cause Heart Attacks in Children Sun Oct 05, 2025 21:31 | imc Top Scientists Confirm Covid Shots Cause Heart Attacks in Children Sun Oct 05, 2025 21:31 | imc

A comprehensive study by leading pediatric scientists has confirmed that the devastating surge in heart failure among children is caused by Covid mRNA shots.

The peer-reviewed study, published in the prestigious journal Med, was conducted by scientists at the University of Hong Kong.

The team, led by Dr. Hing Wai Tsang, Department of Pediatrics and Adolescent Medicine, Li Ka Shing Faculty of Medicine, School of Clinical Medicine, the University of Hong Kong, uncovered evidence to confirm that Natural Killer (NK) cell activation by Covid mRNA injections causes the pathogenesis of acute myocarditis.

Myocarditis is an inflammation of the heart muscle that restricts the body?s ability to pump blood. The Saker >>

Excess Deaths Continue to Climb With No Sign of Slowing Down Thu Feb 12, 2026 19:30 | Nick Bowler Excess Deaths Continue to Climb With No Sign of Slowing Down Thu Feb 12, 2026 19:30 | Nick Bowler

Excess deaths are continuing to climb and show no sign of slowing down, says Nick Bowler. After all the deaths in the Covid years, why was there not a lull? Instead we have 300,000 unexpected deaths and no explanation.

The post Excess Deaths Continue to Climb With No Sign of Slowing Down appeared first on The Daily Sceptic.

US Environmental Protection Agency to Declare CO2 is Not a Dangerous Gas Thu Feb 12, 2026 17:20 | Chris Morrison US Environmental Protection Agency to Declare CO2 is Not a Dangerous Gas Thu Feb 12, 2026 17:20 | Chris Morrison

Get ready, says Chris Morrison. The EPA is about to declare that CO2 is not a dangerous gas. The long-awaited rescission of the 'Endangerment Finding' marks a new chapter in the war against climate catastrophism.

The post US Environmental Protection Agency to Declare CO2 is Not a Dangerous Gas appeared first on The Daily Sceptic.

School Pupils Allowed to Change Gender Under Labour Trans Guidance Thu Feb 12, 2026 15:06 | Will Jones School Pupils Allowed to Change Gender Under Labour Trans Guidance Thu Feb 12, 2026 15:06 | Will Jones

Pupils will be allowed to change their gender at school, according to new guidance published by Education Secretary Bridget Phillipson that critics have said encourages a "dangerous fairy tale".

The post School Pupils Allowed to Change Gender Under Labour Trans Guidance appeared first on The Daily Sceptic.

Transgender Canada School Shooter Was 6ft But Wanted to Be ?Petite? Thu Feb 12, 2026 13:50 | Will Jones Transgender Canada School Shooter Was 6ft But Wanted to Be ?Petite? Thu Feb 12, 2026 13:50 | Will Jones

The transgender teenager?responsible for Canada's worst school shooting?in nearly 40 years wrote online about being 6ft and his desire to be a "petite" woman as well as his fixation with guns and drugs.

The post Transgender Canada School Shooter Was 6ft But Wanted to Be “Petite” appeared first on The Daily Sceptic.

Britain Has Been ?Colonised by Immigrants?, Says Sir Jim Ratcliffe Thu Feb 12, 2026 11:00 | Will Jones Britain Has Been ?Colonised by Immigrants?, Says Sir Jim Ratcliffe Thu Feb 12, 2026 11:00 | Will Jones

Britain has been "colonised" by immigrants who are "costing too much money", billionaire Ineos owner and Manchester United co-owner Sir Jim Ratcliffe has said.

The post Britain Has Been “Colonised by Immigrants”, Says Sir Jim Ratcliffe appeared first on The Daily Sceptic. Lockdown Skeptics >>

Voltaire, international edition

Will intergovernmental institutions withstand the end of the "American Empire"?,... Sat Apr 05, 2025 07:15 | en Will intergovernmental institutions withstand the end of the "American Empire"?,... Sat Apr 05, 2025 07:15 | en

Voltaire, International Newsletter N?127 Sat Apr 05, 2025 06:38 | en Voltaire, International Newsletter N?127 Sat Apr 05, 2025 06:38 | en

Disintegration of Western democracy begins in France Sat Apr 05, 2025 06:00 | en Disintegration of Western democracy begins in France Sat Apr 05, 2025 06:00 | en

Voltaire, International Newsletter N?126 Fri Mar 28, 2025 11:39 | en Voltaire, International Newsletter N?126 Fri Mar 28, 2025 11:39 | en

The International Conference on Combating Anti-Semitism by Amichai Chikli and Na... Fri Mar 28, 2025 11:31 | en The International Conference on Combating Anti-Semitism by Amichai Chikli and Na... Fri Mar 28, 2025 11:31 | en Voltaire Network >>

|

Joe Higgins Banking Inquiry Report - Why Ireland Experienced a Systemic Banking Crisis

national |

economics and finance |

feature national |

economics and finance |

feature

Tuesday February 02, 2016 23:11 Tuesday February 02, 2016 23:11 by T by T

Alternative Analysis and Conclusions to the Report of the Joint Oireachtas Committee of Inquiry into the Banking Crisis By Joe Higgins TD

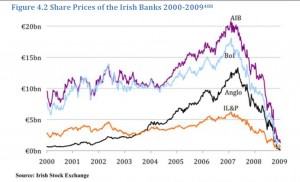

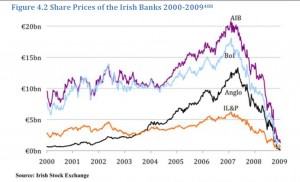

Trajectory of Irish Banks

Forget the official Banking Inquiry report because Joe Higgins has written a much more better one and it asks the rights questions and gets to the heart of the matter by putting the whole saga in its proper context -something which the official report couldn't thing as it would mean asking fundamental questions. Indeed the inquriy itself and official report have been steeped in controversary with allegations of coverup because of numerous reports of key officials and whistleblowers in the regulator office and central bank were ignored and their evidence never making into the inquiry. The whistleblower made a formal complaint under the Protected Disclosures Act and (Village Magazine) "outlining a range of detailed concerns about how the Central Bank and some of its legal representatives were omitting huge swathes of vital documents, redacting many of the most crucial pieces of evidence, and delaying release of vital material until it was too late to use them in briefings for public hearings – in at least one case handing them over 24 hours before a scheduled interview about them."

Related Links:

Joe Higgin's Banking Inquiry Report - Jan 2016 |

VillageMagazine: Cover-up upon cover-up. Banking Inquiry to be blown apart |

Joe Higgins website |

Indy Links: The Fake Banking Enquiry. More Cynical Theatre For The Downtrodden Irish Masses? |

Inside the Anglo Irish - The secret tapes |

Audio from Conor McCabe on Banker and Rancher Interests in the Modern Irish Economy

There was also reports of PR firms hired to coach officials on how to avoid difficult and probing questions and phrase answers for damage limitation. It seems there were also key legal firms guiding the whole process. The Village magazine (http://www.villagemagazine.ie/) last month reported on much of this.

Nevertheless, coverup aside and if there was to be at least one major article you wanted to read about the property bubble and banking crash in order to truly understand the dynamics and forces at work, then this report would be the one to read whether you are Left leaning or not.

Joe Higgins who was on Oireachtas Banking Inquriy Committee, released his report on Weds 27th Jan and at 146 pages long it is a huge amount of work and it is clear this has been a very important topic to Deputy Higgins and goes to the core of what Joe sees wrong with the capitalist system.

The first 10 pages of the report consists of basically a summary of facts and findings of the inquiry itself and Joe Higgins analysis of what happened and why. However the meat of the report is contained in the 6 chapters.

Introduction –

Chapter 1 – The Irish bubble in a Global Context

Chapter 2 – The Bubble and the Banks

Chapter 3 – The Relationships beneath the Bubble

Chapter 4 – The ‘Soft Landing’ to the Crash

Chapter 5 – The Slow Road to the Guarantee

Chapter 6 – After the Guarantee: the Cost of the Crisis

Here are some of the headings in a few bullet points from the summary of JH's Report

- Extreme Profiteering driven by corporate greed drove the property bubble and caused the crash

- Bubble Governments of Taoiseach Bertie Ahern, Tánaiste Mary Harney, Finance Ministers McCreevy & Cowen served the interests of bankers/developers Not those of ordinary people

- Enda Kenny, Fine Gael Leader, was a silent non Opposition

- Dismal failure of Central Bank/Financial Regulator rooted in deregulation mindset of Fianna Fail/PD Government; Regulator must take full measure of responsibility but political establishment must not be allowed to scapegoat

- Government supposed to put interest of ordinary citizens first but FF/PD Government betrayed that trust to serve interest of bankers/speculators

- The Reckless Behaviour that inflated the bubble and caused the crash should have been criminalised

- Politicians, Bankers, Bondholders and Developers responsible for the bubble should have been facing jail instead of golden pensions:

- Banking & Home Provision should not be subject to exploitation and profiteering but should be public services

- The soft landing alibi - a big lie

- Significant sections of the Media not only glamourised and cheerled the bubble but were actors in it

And rather than paraphrase the report here are some important extracts.

Witness after witness at the Banking Inquiry, including bankers and developers themselves, attested to the kind of cut throat competition between them for profit that drove the reckless lending practices that inflated the property/banking bubble and led to the disastrous economic crash. Dermot Gleeson, the Chairman of AIB from 2003 to 2009 testified as to how his bank aped the methods of Anglo Irish Bank which was lending recklessly to developers and raking in major profits. He maintained that they had a problem of: Anglo being held up to us as an exemplar…Commentators in Ireland and abroad repeatedly said,

“Anglo is the best bank. Why can’t you be more like Anglo?” It was determined by one international consultancy to be the best bank of its size in the world. It was the darling not just of the Irish but of European stock exchanges generally…

Ethna Tinney, who was an independent Non-Executive Director of EBS 2000-2007, told the Inquiry:

The belief that there were substantial profits to be made for the society from these developments led us to emulate our peers…There was a sort of feeding frenzy as the banks clambered over one another to get a piece of the action, especially as new foreign banks had entered the market as competitors…There was a sense that we were becoming a minnow as INBS expanded its lending and started to post profits that were up to five times the profits we were posting.

Ms Tinney was highly critical of practices such as securitisation referring to herself having an image of it ‘as a shark eating its own entrails’ She further claimed that ‘The banks have absolutely no sense of guilt about what they have done. And if left unchecked, they are going to do it all over again.’

The extreme drive for profits was encapsulated in the figures given to the Inquiry whereby the six banks eventually covered by the Guarantee, increased lending exponentially from €120 billion in 2000 to almost €400 billion by 2007, raked in €25 billion in profits from 2002 to 2008 and paid those banks Chief Executives an astounding total of €71 million in salaries and bonuses. This was then adversely mirrored in the disastrous €65 billion these banks lost in the crash.

The political leaders of the Fianna Fail/ Progressive Democrat Government 1997 -2007 relentlessly pushed the deregulation in financial services that resulted in this competitive race to the bottom in banking standards as major banks vied for profits. Taoiseach Bertie Ahern told an Irish Banking Federation lunch in March 2006; ‘the Government is very conscious of its role in assisting you to maintain a healthy bottom line . . .there is a need to be more balanced and less negative about the essential services you provide.’

In March 2007, Mr Ahern was positively touting Ireland as a deregulated state for bankers when he told a breakfast meeting of the Financial Services Industry in New York, ‘Our commitment to supporting foreign direct investment is absolute. Ireland is very lightly regulated compared with most of our European colleagues.’

Brian Cowen who became Finance Minister in 2004, was as enthusiastic as his Leader. In a speech to the Institute of Bankers in Ireland annual dinner on 2 November 2006, he said:

But, in my view it is the innovation coming from within the sector which is the most remarkable driver of change. Increasingly sophisticated derivative products seem to be arriving daily as a sector seeks to become ever more professional in the way it manages and hedges its risks and chases after that elusive higher yield.

Billionaire Warren Buffet described the same derivative products as ‘time bombs’ and ‘weapons of mass destruction.

Brian Cowen continued in what can only be described as an embarrassingly obsequious tone:

Of course, not all of these brave new initiatives are successful. It’s a hard game, but there’s all to play for. Of course, that’s easy for me to say because you are players on the field and I’m just an ardent supporter on the sidelines. I will continue to wear your colours. Mr Cowen’s predecessor, Charlie McCreevy, who was Finance Minister from 1997 to 2004 agreed at the Inquiry that he was a ‘champion of the free capitalist markets’. He told the Financial Regulator in 2005 (now as EU Commissioner): Don’t try to protect everyone from every possible accident. . . .many of us in this room . . . were part of the ‘unregulated generation’ – the generation that has produced some of the best risk takers, problem solvers and inventors.

The biggest political party in opposition in the Dail during the bubble was Fine Gael. At his appearance at the Inquiry, Enda Kenny, Fine Gael Leader from 2002, wasn’t in a position to point to a single instance where he had demanded restrictions or regulation on the profiteering that was rampant in the property market.

The Reckless Behaviour that inflated the bubble and caused the crash should have been criminalised

Politicians, Bankers, Bondholders and Developers responsible for the bubble should have been facing jail instead of golden pensions

It is often bemoaned that a miniscule number of former bankers - and no developers - have been charged with any crimes arising out of the blowing up of a gargantuan bubble of property speculation up to 2008 that saw six Irish banks shovelling out massive loans and reaping massive short term profits before an inevitable and catastrophic crash that devastated the lives of countless people in this State.

This is usually put down to a lack of any will among the political, economic and legal establishment to call former bastions of the same establishment to account. While this is undoubtedly true, the much more fundamental reason is that the vast majority of transactions that inflated the bubble over more than ten years, and saw fabulous short term profits for speculators and bankers, were quite legal. It was, and still is, legal to engage in the most outrageous speculation in urban building land. It was quite legal, as Quinlan Private did in 2001, to buy 11 acres of building land in Stillorgan for €32 million on behalf of a group of rich individuals and, without putting a brick on top of another, to sell it four years later for €85 million, a speculative gain of €53 million.

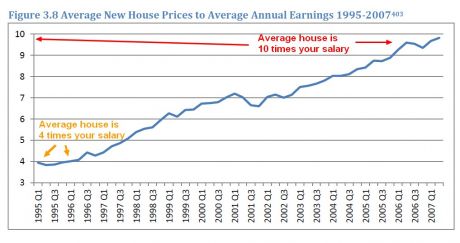

It was perfectly legal to put such speculative profits on the shoulders of young people buying homes and shackle them into mortgages of thirty five or forty years duration with an horrific level of monthly mortgage payments. Because this was how ‘the markets’ worked and a consistent majority in the legislature politically prostrated before those markets, powerful institutions and individuals were fully within the law in profiteering at will even if this meant that one of the most basic human needs, a modest place to live, was denied to very many and, for others, came at an appalling cost in human terms including the stress of trying to pay for the speculative gains of developers and bankers and beyond them the bondholders and the financiers in the European financial markets, - faceless, unelected and unaccountable to those they exploited.

The actions of the bankers, developers and the bondholders who financed them to inflate the bubble were blatantly anti-social. They caused enormous stress to a generation of young home purchasers during the bubble. They skewed the economy toward parasitic speculation and away from productive investment. As the bubble inevitably crashed they caused traumatic dislocation with savage cuts in public services, massive unemployment, the forcing out of their country of hundreds of thousands of working people.

The actions that caused this massive destruction were largely legal. By any standards they should have been seriously criminal. Had these activities been subject to laws that would have protected the big majority in society, all the central actors in the inflation of the bubble from bankers to developers to financing bondholders and the politicians that facilitated them, would have been facing criminal sanction and imprisonment instead of enjoying gold plated pensions.

As the Public Hearings were broadcast and the wide cast of bubble and crash actors came before the Committee, it was remarked to me again and again by ordinary people who were the victims of their actions, how much it galled to see how utterly immune they were to any legal sanction because the whole system had been legally rigged in their interests.

Banking & Home Provision should not be subject to exploitation and profiteering but should be public services

The disaster of the bubble and crash scream out that critical industries such as banking and the provision of homes should not be the subject of speculation, exploitation and profiteering by private interests. Hundreds of thousands of people are still suffering very severe hardship because that was, and is, the case until now. The horrific current housing and homelessness crises is a direct result. Banking and the provision of homes should be public services run in the interest of the needs of society as a whole.

The soft landing alibi - a big lie

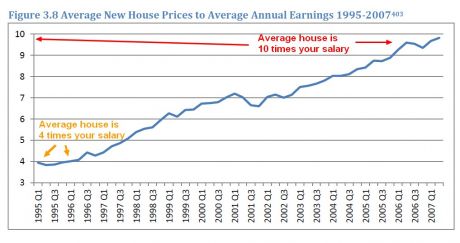

The major excuse given to the Inquiry by developers, regulators, establishment politicians and international agencies for not taking strong action at any stage to stop the madness was that one and all expected a ‘soft landing’ to the property boom. The implication is that had such an end to the boom occurred, the policies and practices they followed would have been vindicated. That means it would have been fine to gouge a generation of young workers with a fourfold increase in the price of a new home in ten years necessitating them taking out 35 to 40 year mortgages with draconian levels of monthly repayments - all for the basic human right of a modest home.

More fundamentally, however, to believe that all expected a ‘soft landing’ is to believe a big lie. To believe this, you have to ignore all the past history from all over the world of previous property bubbles and busts, including recent crises in the US, UK and Scandinavia, as well as models used by the industry itself of the property market cycle. An alternative explanation is that bankers and property speculators did know on some level that a crash was inevitable but were so blinded by the huge profits they were making that hardly any of them ’got out on time'. Evidence presented to the Inquiry showed some estate agents were warning their clients off Irish commercial property from 2005, while from 2004 many of the big developers were diversifying outside of Ireland – which was one reason a third of the loans that ended up in NAMA were for commercial property overseas. Even Anglo made some half-hearted efforts to rein in Irish development lending in 2006.

Meanwhile an elite consensus was constructed around the fairy-tale of a ‘soft landing’ by property and banking interests and their political supporters, with the eager assistance of a media dependent on property advertising. This encouraged first-time buyers to keep taking out huge mortgages and helped keep the bubble going for bankers and developers until the last possible minute. Dissenters who called the crash were pilloried as unpatriotic ‘merchants of doom’ ‘talking down the economy’. Taoiseach Bertie Ahern even said they ‘should go off and commit suicide’.

The Central Bank was less crassly offensive but equally committed to not ‘frightening the horses’. Imprisoned by the ‘pro-cyclical boom/bust nature of capitalism, all concerned downplayed the crash for fear that taking their heads out of the sand and admitting the truth would cause a loss of ‘confidence’, spread ‘contagion’ and undermine profits. This profoundly undemocratic aspect of the capitalist economic cycle is of course treated as the natural order of things, no more avoidable than the weather. Like ancient peoples prayed for the coming of the rains or the ending of the floods, today we pray the ‘confidence fairy’ will charm the gods of the markets.

Our Analysis and Conclusions

Causes of the Crisis - International context, Chapter 1

- *A key context in the creation of the massive financial/property bubble in Ireland up to 2007 and subsequent crash was the policy of successive Irish governments in developing the State as an international haven for capital from higher tax and intrusive regulation. This allowed the ballooning of loans from the European financial markets into the Irish banks as they competed with each other in reducing credit control as these funds were passed on for speculative development.

- *The debate about whether the crisis was primarily home-grown or international in nature is misconceived. The crash resulted from Ireland’s peripheral insertion in the global capitalist system at a time of crisis. Ireland was particularly badly hit because of its over-reliance on Foreign Direct Investment and underdevelopment of the indigenous economy, which led it to deregulate finance to attract in foreign capital and also to over-investment in non-productive areas of the economy i.e. property.

The Property Bubble, the Banks, and the Relationships Beneath the Bubble Chapters 2 & 3

- * The fundamental basis of the property bubble was that greed for super profits by major landholders, bankers and developers was facilitated by the capitalist ethos underpinning the legislation governing banking, land speculation and construction development.

*Private corporations, land speculators and speculators on the financial markets were enabled to put profit maximisation before the needs of the majority in society.

- *The constant of a right wing majority in Dáil Éireann, ideologically committed to the capitalist market system, before and during the bubble, meant that legislation enacted facilitated private greed at huge cost to social needs.

- *The crisis was primarily caused by profit-seeking, speculation and profiteering by banks, builders and property developers, both in Ireland and internationally. This led to reckless lending and a giant credit bubble that drove up the cost of development land, construction costs and house prices

- *Commercial property lending to developers, builders and property investors rather than borrowing by ordinary owner-occupier mortgage holders was what brought down the banks. AIB, BOI & Anglo had combined commercial property loans of €8.63 billion in 1998. By 2008 the combined total was €146.7 billion – an increase of 1,600%

- *Profit-seeking led to destructive competition between banks as they sought to win market share from each other. Competition led to banks cutting interest rates and making lower margins so that the only way to compensate was to recklessly increase the volume of lending and make riskier loans. All this was exacerbated by the entry of foreign banks into the Irish market whose large overseas businesses meant they could afford to make a loss temporarily in the Irish market to enable them to win market share.

- *Competitive deregulation within the financial services sector was an aggravating factor. This was pushed by government to attract foreign direct investment (FDI) and boost the profits of domestic banks and Irish capital. The banks themselves progressively cut their lending standards to compete with their rivals.

- *Lobbying by the financial institutions had a strong influence on deregulation. The banks in general had excessive influence over government and Central Bank/Financial Regulator policy

- *The dominant neoliberal ideology dictated that the government should not interfere in markets apart from encouraging competition between financial institutions. As the Nyberg Report puts it: ‘. . .the paradigm of efficient markets provided the intellectual basis for the assumption that financial markets, left essentially to themselves, would tend to be both stable and efficient.’ This led to light touch regulation also referred to a ‘principles based’ regulation. This really meant ‘trusting’ the banks to regulate themselves – all leading to the promotion of even fiercer competition, thereby facilitating the banks’ profit-seeking and the growth of a credit bubble.

- *Ireland’s peripheral status within the European Union was shown by successive government’s subservience to the ECB even when its diktats placed a huge burden on working people.

- *A small group of capitalists profited from the bubble and caused the crash.

- *An excess of liquidity – cash – on global money markets because of rising wealth inequality fuelled the property bubble and then caused the crash by giving banks the funds with which to recklessly expand their lending in pursuit of higher profits.

*Excessive government spending was not a cause of the crisis. Ireland had the lowest rate of public spending as a percentage of GDP in the EU-27 throughout the pre-crisis period.

- *Property-related tax breaks which were really just tax shelters that incentivised investment in unproductive activity, sucking investment away from economically or socially useful purposes were an important direct factor in the bubble and the crash. Neither the bubble nor the crash would have been as large without them but there would still have been a bubble and a crash, as happened internationally.

- *Over-reliance on property-related taxes was another factor in the severity of the crash. However, the restructuring of the tax base since has shifted this cost onto workers and the poor, rather than increasing taxes on corporations and the wealthy, which are more ‘sustainable’ sources of taxes from the perspective of the majority of the population.

*The media’s dependence on property advertising, capitalist ownership, neoliberal ideological conformity and shared interests and identification with capitalist interests led it to cheerlead the bubble and to largely ignore signs of the oncoming crash.

Contents of the Report

- Introduction – pages 1-11

- Chapter 1 – The Irish bubble in a Global Context pages 12-39

- Globalisation

- The EU’s role in globalisation

- Financialisation

- Increasing Inequality

- Neoliberal ideolog

- Chapter 2 – The Bubble and the Banks pages 40-67

- Introduction

- Bill Black’s Recipe: How Banks Make Profits and Bankers Get Rich

- Grow like Crazy!

- …through property lending

- ‘Make Terrible Quality Loans’

- The Growth of Commercial Property Lending

- …especially development lending

- Use Pathetic Underwriting! Cut costs & credit standard

- Chapter 3 – The Relationships beneath the Bubble pages 68-95

- The Property Industry: Where did all the money come from and Who was Getting Rich?

- Land speculation is central to developers’ profits

- The property investment pyramid scheme

- Boom & Bust: The Capitalist Property Cycle

- Too Blinded by Profit to See the Bubble

- The Structural Influence of Elite Relationships

- Lobbying & Direct Policy Influence

- The Influence of Banks

- The Influence of the Property & Construction Sector

- Negative Impacts of the Bubble on ordinary peopl

- Chapter 4 – The ‘Soft Landing’ to the Crash pages 96-108

- The Tipping Point in 2005

- The authorities ignore the bubble

- ‘Don’t frighten the horses’ ? ‘Pray to the Confidence Fairy’

- The Media

- Late Summer/Autumn 2007: The Crisis Begins

- Chapter 5 – The Slow Road to the Guarantee pages 109-132

- The state prepares for a crisis

- August 2007

- October:

- November

- December

- January 2008

- February

- March

- April-September: The Golden Circle goes into Overdrive

- September 200

- Chapter 6 – After the Guarantee: the Cost of the Crisis pages 133-146

- NAMA

- The Troika Bailout & Not Burning the Bondholders

- The Cost of the Banking Crisis

- Austerity

- Restructuring the tax system to take more from workers and less from capital

- The Impact of Austerity Cuts and Tax Increases

And From - Chapter 2 – The Bubble and the Banks

From the late 1990s to the crash, a ‘world-beating property bubble’116 was blown up in Ireland based on an enormous expansion of credit, particularly from 2003-2008 (Figures 2.1 & 2.2), and growing inequality of wealth. The one and only motive for this lending growth was profit. According to the Nyberg Report:

High profit growth was the primary strategic focus of the covered banks…Since the potential for high growth (in assets) and resultant profitability in Ireland were to be found primarily in the property market, bank lending became increasingly concentrated there.

Within property lending, it was commercial property lending118 to builders, developers, landowners, commercial landlords and other property investors that caused the banks to fail. By 2008, the banks had given out an incredible €158bn in commercial property loans119 – equivalent to Ireland’s entire Gross National Income in 2008120. Traditionally, mortgage lending had been the largest activity for Irish banks but by 2008, commercial property lending had become predominant (Figures 2.3-2.6)121. This was where the vast majority of the banks’ losses came from and where the vast majority of the bank bailout went. The banks with the most commercial property loans made the biggest losses and got the biggest bailouts

The full PDF Report is attached at the end of this article or alternatively is also available here:

http://antiausterityalliance.ie/wp-content/uploads/2016...y.pdf

See also Village Magazine for Jan 12th

Cover-up upon cover-up. Banking Inquiry to be blown apart

http://www.villagemagazine.ie/index.php/2016/01/cover-u...er-up

Joe Higgin's Banking Inquiry Report - Jan 2016

2.41 Mb Joe Higgin's Banking Inquiry Report - Jan 2016

2.41 Mb

|

national |

economics and finance |

feature

national |

economics and finance |

feature

Tuesday February 02, 2016 23:11

Tuesday February 02, 2016 23:11 by T

by T

printable version

printable version

Digg this

Digg this del.icio.us

del.icio.us Furl

Furl Reddit

Reddit Technorati

Technorati Facebook

Facebook Gab

Gab Twitter

Twitter